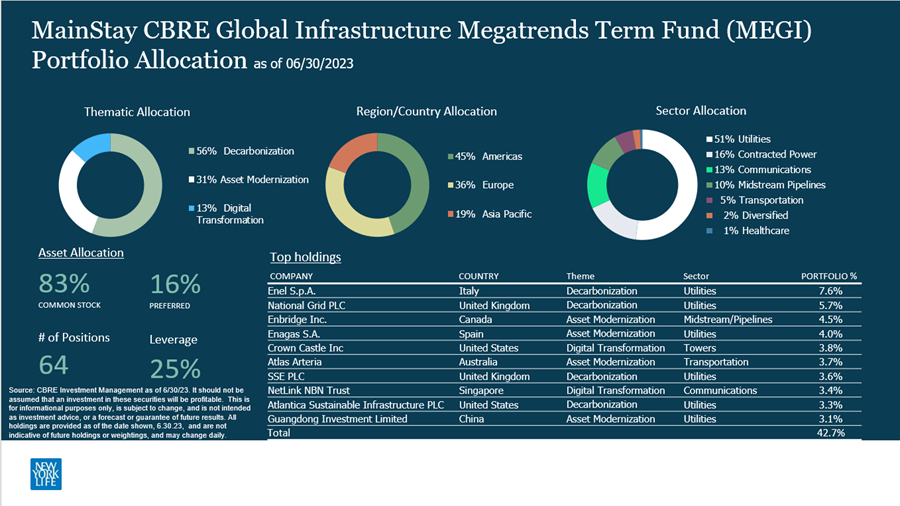

Our strategy is to target companies that own, operate, and develop core infrastructure assets. Our focus is on companies with resilient cash flows and what we believe to be sustainable income growth. The portfolio currently owns 64 positions, so relatively concentrated, 83% to common equity securities, 16% to preferred shares.

The portfolio uses leverage with the goal of enhancing distributions to our shareholders. At the end of the quarter, the leverage level was 25%. And we've reduced it. Nine months ago, leverage was at 32%. We've taken that down. But while we've reduced leverage, it remains elevated, and it reflects our positive total return outlook.

In terms of geographic focus, we focus on developed markets, so the portfolio is currently allocated across 46% to the Americas, US, Canada. We have some exposure to Latin America as well, Europe, UK, also the continent, 35% of the portfolio, and the Asia Pacific region, the remaining 19%.

In terms of the fund's thematic tilt, decarbonization is the largest thematic sleeve, 56% of the portfolio. The asset modernization, which owns approximately 31%, and there our allocation is across toll road companies as well as midstream energy companies. Digital transformation, 13% of the portfolio. This is our investments across communication towers, fiber networks, and data center assets.

Overall, we believe the portfolio is well positioned to continue to generate attractive returns in the current market environment.