Featuring:

David Leggette

Lead Product Strategist and Head of Marketing

CBRE Investment Management

Analysis of similar historical environments may suggest favorable market conditions for global real estate investment. The CBRE Global Real Estate Income Fund (ticker “IGR”), provides exposure to income-producing equity securities that the Fund's management team believe are attractively valued. In this CEF Insights Podcast episode, CBRE Investment Management Lead Product Strategist, David Leggette discusses the investment approach of IGR, real estate market valuations, and current market opportunities.

The CBRE Global Real Estate Income Fund, ticker IGR, seeks high current income and capital appreciation by investing globally with an emphasis on the income-producing common equity and preferred stocks of real estate companies.

Transcript:

Welcome to CEF Insights, your source for closed-end fund information and education, brought to you by the Closed-End Fund Association. Today we are joined by David Leggette, Lead Product Strategist and Head of Investor Relations with CBRE Investment Management, a leading investment manager of Global Real Assets. David, we're happy to have you with us today.

It's my pleasure. Thank you for the opportunity.

David, investors today have access to a range of investment solutions which provide exposure to listed and private market real estate investments. Your company manages the CBRE Global Real Estate Income Fund, which trades under the ticker IGR. Can you discuss the characteristics of IGR and what may differentiate it from other investment solutions available to them?

Sure. Relative to the other options, we think IGR is one of the best ways for individual investors to gain exposure to real estate. IGR is actively managed by CBRE Investment Management Listed Real Assets Team, and we've been managing the Fund since its inception in 2004. So over its nearly 20 years of operation, I believe we've established a strong track record of delivering against the Fund's primary objective of high current income and the secondary objective of capital appreciation. IGR invests globally in publicly traded companies that own and operate real estate assets.

IGR historically has paid distributions to its shareholders on a monthly basis with the goal of maintaining a level rate that may rise over time. So we believe IGR is best suited for investors seeking real estate exposure as well as high current income. On that topic of income, much like many other funds during the global financial crisis in 2008, IGR had to reduce its distribution, so we moved it down to four and a half cents per share on a monthly basis in November of 2008. But since then we've raised our distribution two times. The most recent increase was last year in March of 2022, where we raised our distribution 20% and it's current monthly distribution amount is 6 cents per share or 72 cents annually.

You mentioned that CBRE investment management is an active manager. Can you expand on your investment style and approach?

Our investment process combines top-down sector and regional allocation, bottom up stock selection, and we seek to construct a relatively concentrated portfolio that can deliver against the Fund's investment objectives. We invest across common equity securities primarily, but we also invest a smaller portion of the portfolio in higher yielding preferred equity securities. Our process, it places an emphasis on property sectors our team believes will outperform as well as individual companies that offer what we believe to be an attractive mix of above average income and growth potential. Finally, our team utilizes a non-structural form of leverage, a line of credit with the goal of delivering higher amounts of income to our shareholders.

David real estate was one of the worst performing sectors in 2022. Coming off a challenging year, do you believe the current environment is attractive to allocate real estate?

I do believe it's an attractive environment today. 2022 was one of the worst calendar years of performance for global real estate securities in the last 20 years. The FTSE EPRA NAREIT Developed Index, a well-known global real estate index, it was down 24%. Real estate is a capital intensive business. As such, real estate stock prices are sensitive to changes in interest rate costs. So in our view, last year's underperformance was largely driven by the Fed's aggressive stance on inflation and their rapid increase of interest rates.

Despite their poor performance, real estate company earnings have remained relatively stable and attractive and we've continued to see company income growth in excess of their earnings. So against this backdrop, we think real estate is attractively valued today. In our view, the bad news of higher rates and softening economic conditions are already priced in to the stock prices of these companies.

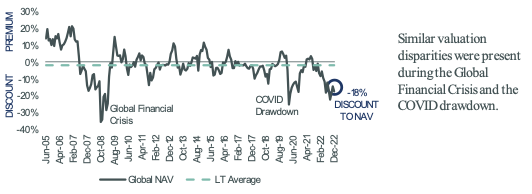

One way to think about valuation is to compare the value of a company's stock price to the estimated private market value of a company's underlying real estate. On this basis at year-end, we estimated global real estate stocks are trading at an 18% discount to the private market value of their real estate owned. Historically, we saw similar discounts in the Global Financial Crisis in 2008 and the COVID drawdown of 2020. In our view, pricing dislocations mean listed real estate stock prices and the value, the private market value, of their real estate owned, dislocations like this have led historically to attractive returns for investors.

GLOBAL REAL ESTATE SHARE PRICE PREMIUM/DISCOUNTS TO ESTIMATES OF PRIVATE MARKET VALUE

Source: CBRE Investment Management proprietary investment universe data through 12/31/2022. Global real estate share price premium/discounts represent the Advisors comparison of individual company stock prices to the estimated value of the commercial real estate owned. Information is the opinion of CBRE Investment Management, which is subject to change and is not intended to be a forecast of future events or construed as investment advice. Past performance is no guarantee of future results.

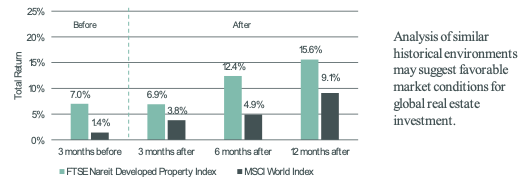

As we turn the page and look into 2023, we believe we are nearing the end of the Fed tightening cycle and this is a positive catalyst for global real estate. For example, we compared the performance of the FTSE EPRA NAREIT Developed Index, global real estate index and the MSCI World Index, at the end of the last four interest rate cycles in 1995, 2000, 2006 and 2019.

Based on the history of the most four recent Fed pauses, global real estate outperforms global equities in the three months prior to the Fed pause by an average of 5.6%. And global real estate outperforms global equities in the 12 months after a Fed pause on an average of six and a half percent. So global real estate stocks in and around changes in Fed policy, pauses in tightening cycles, have delivered attractive absolute and relative returns relative to global equities. So our conclusion after sort of analyzing historical market environments similar today, it suggests that conditions are favorable for global real estate investment.

GLOBAL REAL ESTATE PERFORMANCE BEFORE AND AFTER FED PAUSES

Source: CBRE Investment Management and FTSE EPRA Nareit Developed Index, and MSCI World Index. The FTSE EPRA Nareit Developed Index is designed to track the performance of listed real estate companies and REITS worldwide. By making the index constituents free-float adjusted, liquidity, size and revenue screened, the series is suitable for use as the basis for investment products, such as derivatives and Exchange Traded Funds (ETFs). The MSCI World Index captures large and mid-cap representation across 23 Developed Markets (DM) countries*. With 1,508 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. Historical performance is calculated before and after dates when the Fed signaled a pause in rate hikes (03/28/1995, 06/28/2000, 08/08/2006, and 01/30/2019). Total returns for periods in excess of one year are annualized. Information is the opinion of CBRE Investment Management and is subject to change and is not intended to be a forecast of future events, or a guarantee of future results, or investment advice. Forecasts and any factors discussed are not indicative of future investment performance.

Economic and market data and projections contained herein are presented for illustrative purposes only and are not reflective of actual or expected performance of the Fund. The achievement of the projections is subject to numerous risks and uncertainties. Actual economic results may vary materially from projections contained herein, which may adversely affect the performance of the Fund and the value of your investment.

What investment themes does CBRE currently favor?

Looking out in 2023, we expect property sectors aligned with long-term secular investment themes to perform well, especially in an accelerated economic environment. Secular themes in real estate are important because we believe they will drive increased demand for space, providing landlords the pricing power to increase rents, which then leads to higher earnings and income growth. Here are a couple examples of the secular themes in real estate.

The first, demographics and generational change. And here it's really about housing affordability and the rising home ownership costs is leading more and more people, especially the younger generations, to pay rent and not mortgages. This dynamic supports continued demand within the residential sector. The second secular team is digital transformation and increased demand and growth of data. One area, for example, we don't see big technology companies cutting is their IT budgets. So we've seen continued demand for things like cloud-based storage and the ongoing build out of 5G networks to drive growth potential in the data center and tower REITs. Third and final trend, e-commerce. Within this trend, you have increased penetration of online sales as well as the shorthanded expectations for delivery times from weeks to days to now hours, same day delivery. We believe these dynamics will continue to support growth in modern logistic facilities within the industrial sector.

David, closed-end fund investors are often income oriented and income is a primary objective of IGR. Can you provide an overview of the Fund's distribution policy?

Over the life of the Fund, our goal is to maintain an attractive distribution which may grow in time. We believe the relatively consistent earnings and income growth of real estate companies makes the asset class a good match for a closed-end fund like IGR that's focused on maintaining attractive monthly distributions. We seek to maintain a distribution rate that does not exceed the NAV growth of the Fund over time and therefore minimizes return of capital. Under the Fund›s managed distribution policy, the objective is our monthly distributions may be covered by both net investment income as well as any capital gains we realized through the course of active management. To the extent that we realize capital gains, our preference is to include the gain as part of the Fund's regular distribution on a monthly basis as opposed to paying out a large one-time special distribution.

David, how do you see a global real estate strategy best positioned in an investor's portfolio?

Many of the shareholders we engage with utilize IGR as part of an income portfolio. Real estate, in general, works well alongside fixed income investments, offering an alternative source of income with growth that historically has displayed a low correlation to bonds. While investors may continue to allocate to IGR from fixed income investments, we may see more allocations coming from broad equities given global real estate's attractive valuations and total return potential.

David, thank you for taking the time to share your thoughts with us today.

You're very welcome. I appreciate it. And for all those shareholders that listen to this podcast, we appreciate your interest. Thank you.

And we want to thank you for tuning into another CEF Insights podcast. For more educational content, please visit our website at www.CEFA.com.

CEFA:

We want to thank you for tuning in to another CEF Insights Podcast.

Audio recorded in February 2023.

Disclosure

This material is not and is not intended as investment advice, an indication of trading intent or holdings or the prediction of investment performance. All fund specific information is the latest publicly available information. All other information is current as of the date of this presentation. All opinions and forward-looking statements are subject to change at any time.

CBRE Investment Management disclaims any responsibility to update such views and or information. This information is deemed to be from reliable sources. However, CBREIM does not warrant its completeness or accuracy. This presentation is not intended to and does not constitute an offer or solicitation to sell or a solicitation of an offer to buy any security, product, investment advice or service, nor shall any security, product, investment advice or service be offered or sold in any jurisdiction in which CBREIM is not licensed to conduct business and or an offer, solicitation, purchase or sale would be unavailable or unlawful.

Investments involve risk. Principle loss is possible. Real estate investments are subject to changes in economic conditions, credit risk and interest rate fluctuations. International investments may involve risk of capital loss from unfavorable fluctuation in currency values from differences in generally accepted accounting principles or from economic or political instability in other nations. Because real estate funds concentrate their investments in the real estate industry, the portfolio may experience more volatility and be exposed to greater risk than the portfolios of other funds.

Closed-end funds are traded on the secondary market through one of the stock exchanges. The Fund’s investment return and principal value will fluctuate so that an investor’s shares may be worth more or less than the original cost. Shares of closed-end funds may trade above (a premium) or below (a discount) the net asset value (NAV) of the fund’s portfolio. There is no assurance that the Fund will achieve its investment objective.

Investors should consider a fund’s investment objectives, risks, charges and expenses carefully before investing. A copy of the prospectus that contains this and other information about the Fund may be obtained by either calling 888-711-4272 or visiting www.cbreim.com/igr. Please read the prospectus carefully before investing. Investing in closed-end funds involves risk, including possible loss of principal. Past performance does not guarantee future results.

The FTSE EPRA Nareit Developed Index is designed to track the performance of listed real estate companies and REITS worldwide. By making the index constituents free-float adjusted, liquidity, size and revenue screened, the series is suitable for use as the basis for investment products, such as derivatives and Exchange Traded Funds (ETFs).

The MSCI World Index captures large and mid-cap representation across 23 Developed Markets (DM) countries*. With 1,508 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Generally, the Fund will invest at least 80% of its assets in income-producing global real estate equity securities, which include common stocks, preferred securities (up to 20% of these may be below investment grade), warrants and convertible securities; up to 15% of assets may be invested in emerging market countries (which are subject to additional risks). Investment in the Fund is also subject to risk from the use of leverage.

Registered Representative Services: Foreside Fund Services, LLC